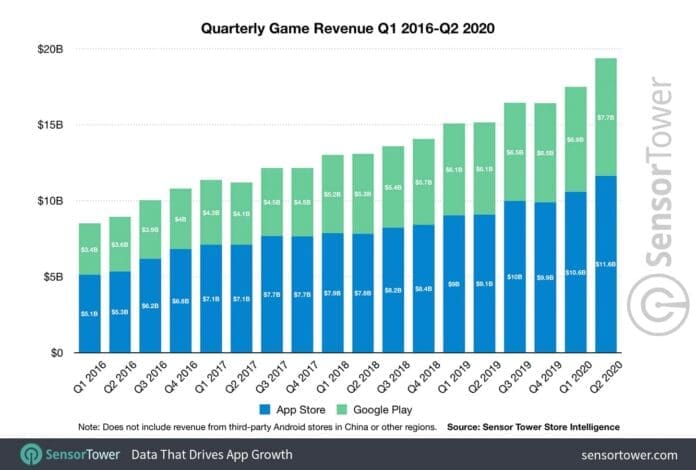

Today, the average age of a mobile gamer is 36.3 ( compared with 27.7 in 2014), the gender split is 51% female, 49% male, and one-third of all gamers are between the ages of 36-50 - a far cry from the traditional stereotype of a “gamer.” From casual games to the recent rise of the wildly popular hyper-casual genre of games that are quick to download, easy to play and lend themselves to being played in short sessions throughout the day, games are played by almost every demographic stratum of society. Apps are the new prime time, and games have grabbed the lion’s share.Īccessibility is the highest it’s ever been as barriers to entry are virtually non-existent. By 2021, this number is predicted to increase to more than 30 minutes. In the U.S., time spent on mobile devices has also officially outpaced that of television - with users spending eight more minutes per day on their mobile devices. In fact, 50% of mobile app users play games, making this app category as popular as music apps like Spotify and Apple Music, and second only to social media and communications apps in terms of time spent. It’s predicted that in 2019, 2.4 billion people will play mobile games around the world - that’s almost one-third of the global population. Today, mobile games account for 33% of all app downloads, 74% of consumer spend and 10% of all time spent in-app.

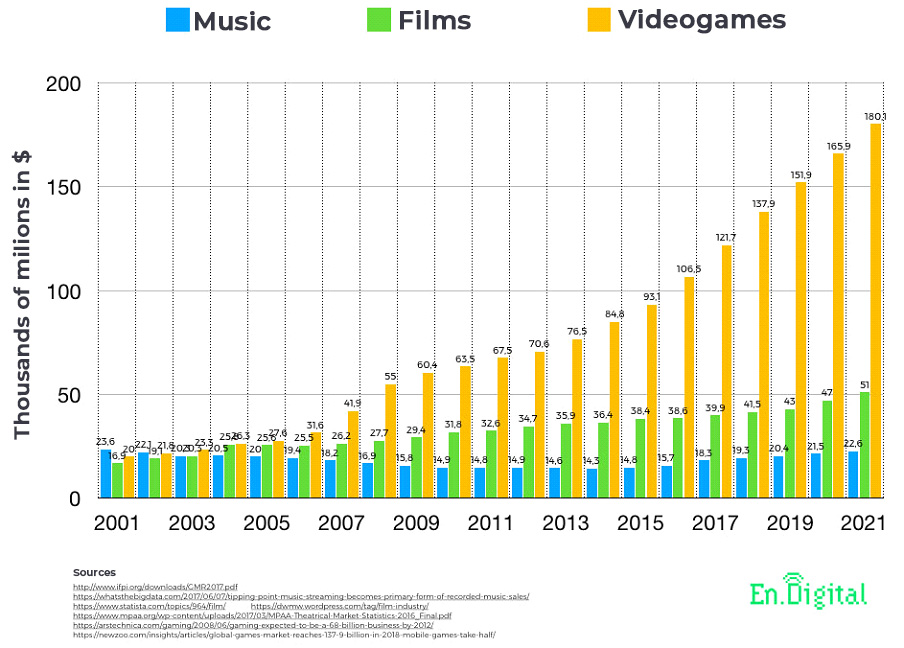

What’s interesting is why everyone is talking about games, and who in the market is responding to this - and how. In fact, over the last 18 months, the global gaming industry has seen $9.6 billion in investments and if investments continue at this current pace, the amount of investment generated in 2018-19 will be higher than the eight previous years combined. With this tremendous growth (10.2% YoY to be precise) has come a flurry of investments and acquisitions, everyone wanting a cut of the pie.

0 kommentar(er)

0 kommentar(er)